Current Affairs

CMD Fashions Owner Mapuranga Accused of Defrauding Clients

The owner of CMD fashions, Consecration Mapuranga, has come under fire following allegations that he defrauded dozens of people through his investment scheme, CMD Investors.

The businessman, who runs Consecration Mega Deals Fashions, is accused of collecting money from individuals with promises of returning it with interest — but several clients claim they have not received their payouts since August.

According to aggrieved investors, Mapuranga encouraged them to invest varying amounts of money, assuring quick returns. However, the promised payments reportedly never came, leaving many people demanding refunds.

One of the affected clients, who preferred to remain anonymous, said they had lost hope of recovering their money.

“We trusted him because he sounded genuine and even showed us proof of other people who were supposedly paid before. But since August, he has been giving excuses,” one of the client said.

In response to the allegations, Mapuranga dismissed the claims, insisting that his businesses are operational and legitimate.

“All of our companies are working. Those who have complaints should go and report to the police,” he said.

Meanwhile, some of the investors say they are now considering taking legal action to recover their funds. Police have not yet issued an official statement regarding the matter.

The CMD Fashions controversy has sparked renewed debate on the rise of informal investment schemes in Zimbabwe, with authorities urging the public to exercise caution and verify the legitimacy of financial ventures before committing funds.

Current Affairs

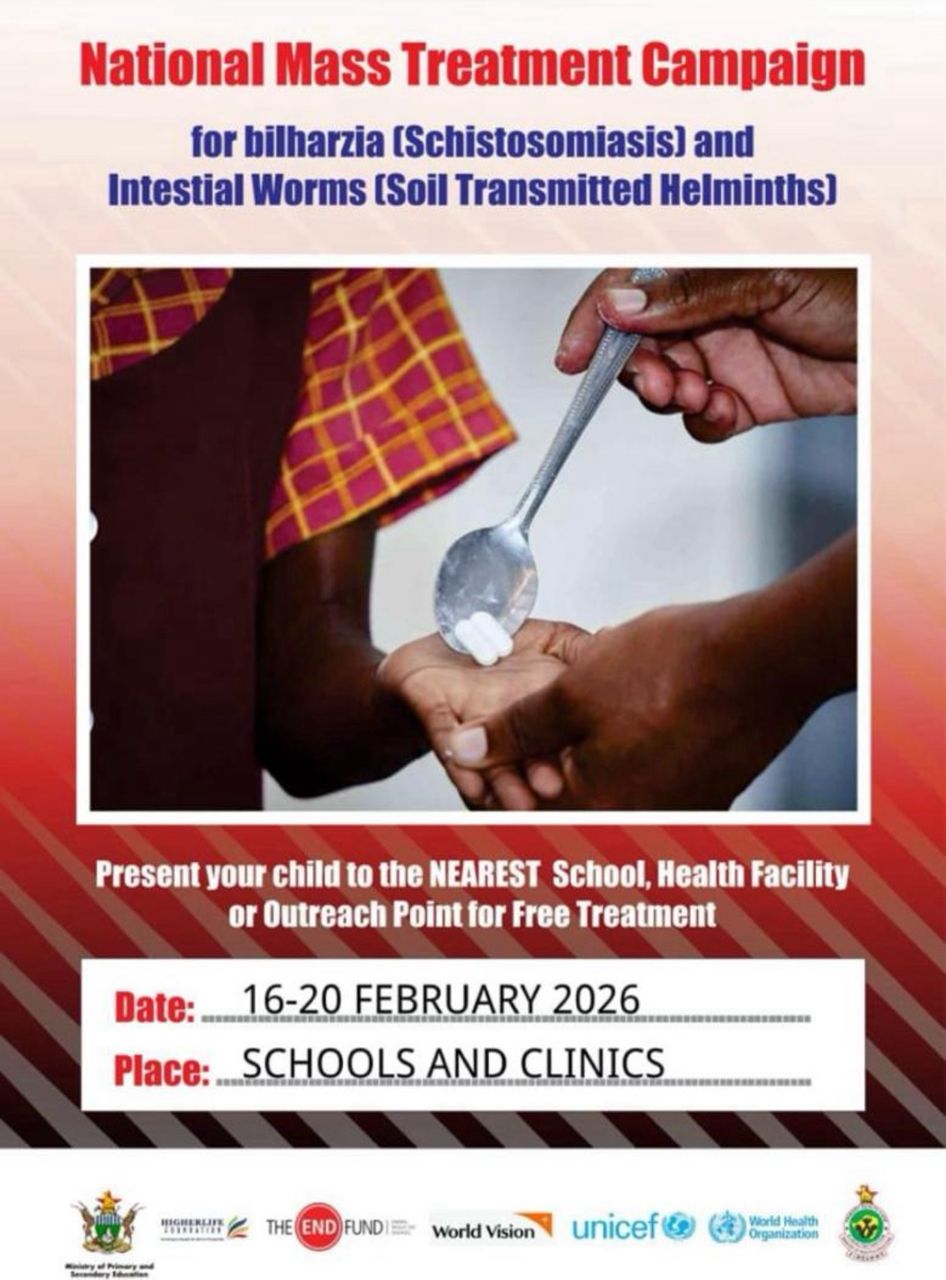

Zimbabwe Launches National Bilharzia Drug Campaign

The Ministry of Health and Child Care has rolled out a nationwide Mass Drug Administration (MDA) campaign targeting schistosomiasis (bilharzia), marking a major step in efforts to eliminate the disease as a public health concern in Zimbabwe.

The campaign, which runs from 16 to 21 February 2026, focuses on protecting children aged 5 to 14 years, the group most vulnerable to bilharzia infection. A total of 1,477,966 children are expected to receive free treatment using Praziquantel, the recommended medication for schistosomiasis.

The MDA targets seven rural provinces: Mashonaland East, Mashonaland West, Mashonaland Central, Midlands, Manicaland, Matabeleland South, and Masvingo areas where the disease remains a persistent health challenge due to limited access to safe water and sanitation.

Treatment will be provided free of charge at the nearest health facilities, primary and secondary schools, and designated static health points, ensuring wide coverage and easy access for both school-going and out-of-school children.

The campaign is being implemented with critical support from key partners. Higherlife Foundation has contributed financial and technical assistance, while the World Health Organization donated the Praziquantel required for the mass treatment exercise.

Health officials say the combined school- and community-based approach is designed to significantly reduce infection rates, prevent long-term complications, and improve overall child health and wellbeing in the targeted provinces.

“This intervention represents a significant milestone in our national goal to eliminate schistosomiasis,” the Ministry said, urging parents, guardians, and communities to support the programme and ensure all eligible children receive treatment.

Schistosomiasis, commonly known as bilharzia, is a preventable and treatable disease. Authorities emphasize that sustained community participation is essential to breaking transmission cycles and safeguarding the health of future generations.

Current Affairs

Government Gazettes Draft Constitutional Amendment No. 3 Bill

The Government has gazetted the draft Constitutional Amendment No. 3 Bill on Monday, 16 February 2026, setting in motion a major constitutional review process that could significantly reshape Zimbabwe’s governance system.

If passed, the proposed amendment would allow President Emmerson Mnangagwa to extend his current term and would fundamentally change how national leaders, including the President, are elected. Parliament has now opened a 90-day period for public debate, after which the Bill will be formally tabled for consideration.

According to the official Memorandum, the Bill is presented as a package of “constructive reforms” aimed at strengthening constitutional governance, improving institutional efficiency, and aligning Zimbabwe’s constitutional framework with practices used in other African countries. Government says the proposals are meant to modernise the 2013 Constitution while preserving its core values.

One of the most far-reaching proposals is the introduction of a parliamentary method of electing the President, replacing the current system of direct presidential elections. Under this model, Members of Parliament would elect the President, with a run-off if no candidate secures an outright majority. The process would be overseen by electoral authorities to ensure fairness and transparency.

The Bill also proposes extending the presidential and parliamentary term from five years to seven years, a move government argues will reduce frequent election pressures and allow more time for long-term development projects to be implemented.

In another major change, responsibility for voter registration and the voters’ roll would be transferred from the Zimbabwe Electoral Commission (ZEC) to the Registrar-General. Government says this will improve efficiency, as the Registrar-General already manages national population records.

The proposed amendment further restructures electoral institutions by creating a Zimbabwe Electoral Delimitation Commission, which would take over boundary-drawing functions. This would effectively remove ZEC’s current dual role, a move authorities say promotes institutional integrity and good governance.

Other provisions include increasing the number of appointed senators to 90, giving the President power to appoint ten senators to bring in technical expertise and promote inclusivity. The Bill also expands the powers of the Constitutional Court, allowing it to hear cases of major public importance beyond constitutional disputes and presidential election petitions.

Several constitutional commissions are also affected. The Bill proposes dissolving the Zimbabwe Gender Commission and the National Peace and Reconciliation Commission, with their functions reassigned to existing bodies such as the Zimbabwe Human Rights Commission. Government argues this will reduce duplication and streamline oversight.

Judicial and security sector provisions are also amended, including changes to the appointment of the Prosecutor-General and clarifying the constitutional role of the Defence Forces.

As the 90-day consultation period begins, the proposed Constitutional Amendment No. 3 Bill is expected to generate intense national debate. Supporters say it promotes stability and efficiency, while critics are likely to question its implications for democracy, accountability, and executive power.

The coming months will determine whether these sweeping changes gain public and parliamentary approval.

Current Affairs

Dr Jenfan Muswere and a Defining Era in Zimbabwe’s Media Transformation

The tenure of Dr Jenfan Muswere, former Minister of Information, Publicity and Broadcasting Services, will be remembered as one of the most impactful chapters in Zimbabwe’s contemporary media history. At a time when the sector faced financial distress, technological lag, and institutional inertia, his leadership marked a decisive shift toward reform, modernization, and accountability.

Widely known as the only minister who consistently spoke without written speeches, Dr Muswere brought a leadership style rooted in mastery of policy, confidence of vision, and direct engagement. His unscripted approach was not theatrical bravado, but a reflection of deep command over the information and broadcasting portfolio—earning respect across government, media practitioners, and industry stakeholders.

Authenticity in Leadership

Dr Muswere’s preference for speaking without prepared texts set a new tone within the ministry. It fostered openness, trust, and credibility, reinforcing a culture where dialogue replaced bureaucracy and decision-making was informed by clarity rather than caution. This approach strengthened institutional confidence and encouraged innovation across the sector.

Completing the Broadcasting Revolution

Among his most significant achievements was the relaunch of ZimDigital Phase 2, a long-awaited milestone in Zimbabwe’s digital broadcasting journey. Under his stewardship, the programme accelerated the expansion of both terrestrial and satellite broadcasting, dramatically improving national coverage and signal quality.

Studios across radio and television platforms were modernized, while Montrose Studios were recapitalized with an ambitious vision to establish 10 fully functional television channels—laying the groundwork for a diversified, competitive digital broadcasting ecosystem.

From Insolvency to Financial Stability

Dr Muswere assumed office at a time when several media houses and grant-aided institutions were technically insolvent. Through targeted reforms and legislative intervention, including amendments to the Broadcasting Services Act, he spearheaded a financial turnaround that redefined the sector’s sustainability.

The most notable transformation occurred at the Zimbabwe Broadcasting Corporation, which moved from persistent losses to operational profitability. Under this new trajectory, ZBC was positioned to generate US$55 million in revenue by 2025, an unprecedented benchmark for the public broadcaster.

Institutionalising Accountability

Beyond revenue growth, Dr Muswere embedded accountability as policy rather than rhetoric. His tenure saw the completion of audited accounts spanning 2016 to 2024, the regularization of Annual and Extraordinary General Meetings, and the commissioning of a forensic audit at ZBC. These measures restored governance discipline and public confidence in state-owned media institutions.

Digitisation Beyond the Airwaves

The digital transformation agenda extended well beyond broadcasting. The launch of Zimpapers Digital marked a decisive shift toward online publishing and multimedia storytelling. Newsrooms were retooled and reoriented to operate in a converged media environment, ensuring relevance in an increasingly digital information economy.

Community Radio and Language Inclusion

A strong advocate for inclusivity, Dr Muswere expanded Zimbabwe’s community broadcasting landscape by licensing 10 new community radio stations, amplifying grassroots voices and local content. He further championed content production in all officially recognised languages, reinforcing cultural representation, linguistic equity, and national cohesion.

His efforts also included moves to re-establish a National Editorial Committee, aimed at strengthening professional standards and ethical journalism.

Financing the Creative Economy

Under innovative revenue strategies, the Ministry mobilised US$60 million from broadcasting licence fees. Crucially, Dr Muswere ensured that cultural development remained central to policy by ring-fencing US$10 million for the growth of the film, music, arts, and culture industries.

Looking ahead, he formally directed that US$10 million be allocated to artists in 2026, institutionalising sustained support for Zimbabwe’s creative sector.

A Legacy of Transformation

As Zimbabwe reflects on Dr Jenfan Muswere’s ministerial tenure, the record speaks for itself. He leaves behind a media sector that is technologically advanced, financially disciplined, digitally aligned, linguistically inclusive, and creatively empowered.

More than reform, his legacy is one of transformation anchored in accountability—a blueprint that will continue to shape Zimbabwe’s information, publicity, and broadcasting landscape long after his departure from office.

-

Current Affairs3 months ago

Current Affairs3 months agoOperation restore order

-

Crime and Courts5 months ago

Crime and Courts5 months agoMasasi High School Abuse Scandal Sparks Public Outcry

-

Crime and Courts5 months ago

Crime and Courts5 months agoKuwadzana Man Jailed for Reckless Driving and Driving Without a Licence

-

Current Affairs7 months ago

Current Affairs7 months agoBreaking: ZIMSEC June 2025 Exam Results Now Available Online

-

Current Affairs6 months ago

Current Affairs6 months agoMunhumutapa Day: Zimbabwe’s Newest Public Holiday Set for Annual Observance

-

Current Affairs4 months ago

Current Affairs4 months agoBREAKING NEWS: ZANU PF Director General Ezekiel Zabanyana Fired

-

Current Affairs6 months ago

Current Affairs6 months agoNo Racism in Our Cricket: Government

-

Current Affairs6 months ago

Current Affairs6 months agoGovernment Bans Tinted Car Windows in Nationwide Crime Crackdown

Angela Gabriel

November 4, 2025 at 6:07 pm

Haa munhu uyu itsotsi 1500us kubva 14 March 2023 upto now anenge achingotaura rough apa wakamupa mari yako kune vanhu more than 30 vakatorera mari dzavo nanhasi hasati avapa mari dzavo varikuchema vamwe dzimba dzaparara