Current Affairs

CMD Fashions Owner Mapuranga Accused of Defrauding Clients

The owner of CMD fashions, Consecration Mapuranga, has come under fire following allegations that he defrauded dozens of people through his investment scheme, CMD Investors.

The businessman, who runs Consecration Mega Deals Fashions, is accused of collecting money from individuals with promises of returning it with interest — but several clients claim they have not received their payouts since August.

According to aggrieved investors, Mapuranga encouraged them to invest varying amounts of money, assuring quick returns. However, the promised payments reportedly never came, leaving many people demanding refunds.

One of the affected clients, who preferred to remain anonymous, said they had lost hope of recovering their money.

“We trusted him because he sounded genuine and even showed us proof of other people who were supposedly paid before. But since August, he has been giving excuses,” one of the client said.

In response to the allegations, Mapuranga dismissed the claims, insisting that his businesses are operational and legitimate.

“All of our companies are working. Those who have complaints should go and report to the police,” he said.

Meanwhile, some of the investors say they are now considering taking legal action to recover their funds. Police have not yet issued an official statement regarding the matter.

The CMD Fashions controversy has sparked renewed debate on the rise of informal investment schemes in Zimbabwe, with authorities urging the public to exercise caution and verify the legitimacy of financial ventures before committing funds.

Current Affairs

Govt Closes Key Harare-Nyamapanda Stretch For Toll Plaza Construction

Itai Mazire

IN A MOVE to enhance road infrastructure and safety, the Government has announced a five-month closure of a critical section along the Harare-Nyamapanda Highway to facilitate toll plaza construction and major rehabilitation works.

The Ministry of Transport and Infrastructural Development, in conjunction with the Zimbabwe National Road Administration (ZINARA), in a statement said that the section between the 40kilometre and 40.5kilometre peg will be completely closed to traffic starting 18 February, until 31 July 2026.

The closure, mandated under the Roads Act, is a necessary step in the upgrading of the vital arterial route.

During this period, all traffic will be diverted onto a detour road, and authorities have called for utmost cooperation from the motoring public.

“The closure is necessary to facilitate toll plaza construction,” it stated.

In a full list of directives to ensure public safety, the Ministry implored drivers to adhere strictly to the following rules:

“Reduce speed when approaching the construction zone and strictly adhere to traffic control signs and signals.

“Drive with due care and attention, exercising patience and following instructions from traffic control personnel.

“Plan for extra travel time to account for potential delays; and”

“Yield the right of way to all construction vehicles and respect the safety of the teams working on-site,” said the Ministry.

The development is expected to impact cross-border hauliers and commuter omnibuses, with delays anticipated particularly during peak hours.

In a closing appeal for understanding, the Ministry stated: “Your patience during this period is greatly appreciated. We look forward to your continued support and cooperation in maintaining road safety.”

The project falls under the ongoing Kilometre by Kilometre road rehabilitation program.

In a related matter the Ministry announced the temporary and partial closure of a route stretching from J.M. Nkomo Street (at the statue) through Masotsha Ndlovu Avenue and Lady Stanley Street, and along Victoria Falls Road up to Masiyepambili Drive.

The closure, which began on 16 February 2026, is scheduled to last until 30 April 2026.

With the affected area being heavily built-up, authorities have outlined specific alternative routes for different vehicle types. Light vehicles will navigate the work zones using “stop-and-go” mechanisms, while residential routes will remain open for local property access. In a critical directive for hauliers, the Ministry stated: “All heavy vehicles must reroute via Masiyepambili Drive to access the CBD.” Access on Old Falls Road will be strictly limited to local residents only.

In a safety advisory issued to the public, the Ministry strongly urged drivers to obey all posted traffic signs, drive with caution at reduced speeds, and allow for extra travel time in their schedules.

Current Affairs

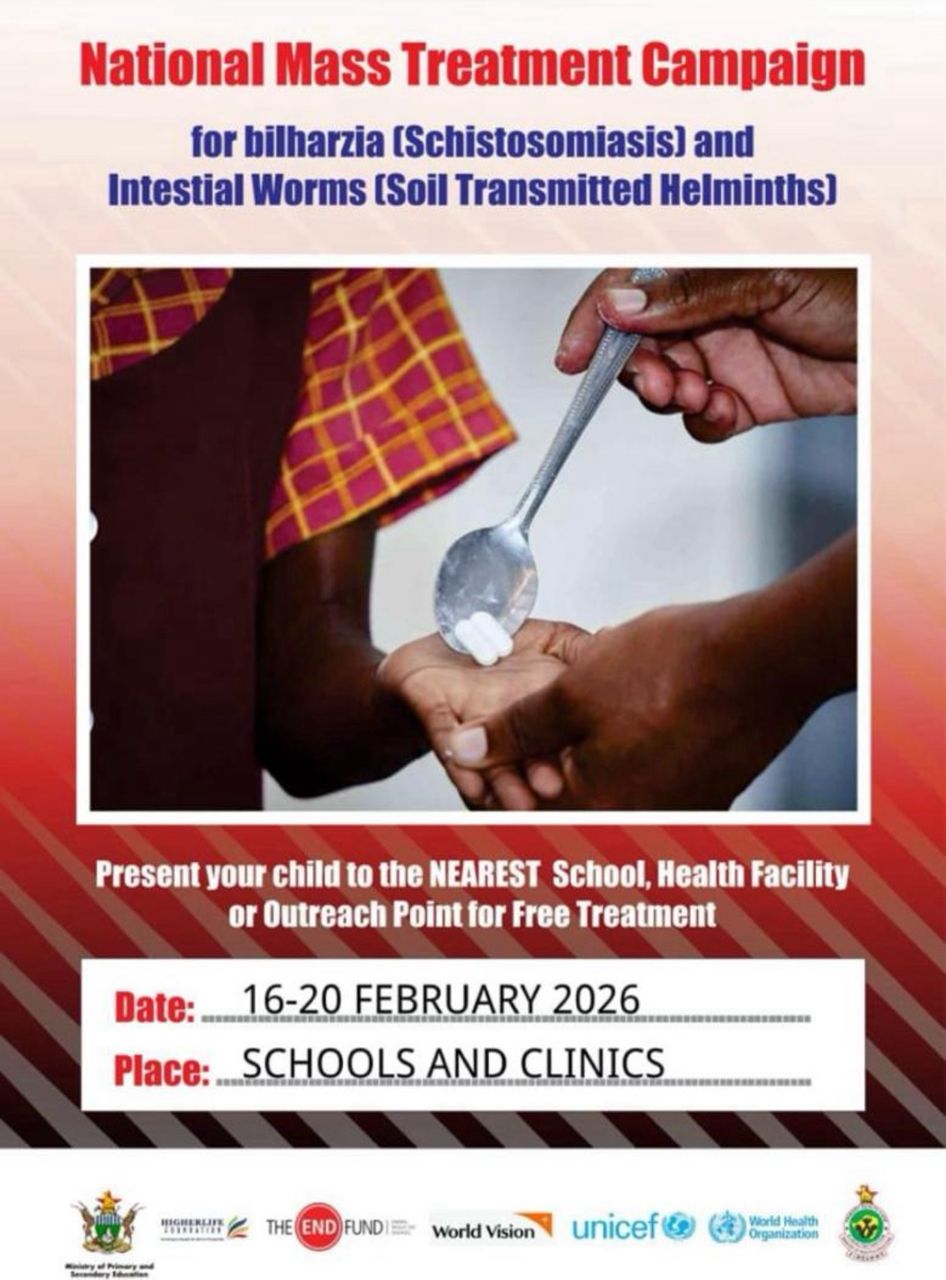

Zimbabwe Launches National Bilharzia Drug Campaign

The Ministry of Health and Child Care has rolled out a nationwide Mass Drug Administration (MDA) campaign targeting schistosomiasis (bilharzia), marking a major step in efforts to eliminate the disease as a public health concern in Zimbabwe.

The campaign, which runs from 16 to 21 February 2026, focuses on protecting children aged 5 to 14 years, the group most vulnerable to bilharzia infection. A total of 1,477,966 children are expected to receive free treatment using Praziquantel, the recommended medication for schistosomiasis.

The MDA targets seven rural provinces: Mashonaland East, Mashonaland West, Mashonaland Central, Midlands, Manicaland, Matabeleland South, and Masvingo areas where the disease remains a persistent health challenge due to limited access to safe water and sanitation.

Treatment will be provided free of charge at the nearest health facilities, primary and secondary schools, and designated static health points, ensuring wide coverage and easy access for both school-going and out-of-school children.

The campaign is being implemented with critical support from key partners. Higherlife Foundation has contributed financial and technical assistance, while the World Health Organization donated the Praziquantel required for the mass treatment exercise.

Health officials say the combined school- and community-based approach is designed to significantly reduce infection rates, prevent long-term complications, and improve overall child health and wellbeing in the targeted provinces.

“This intervention represents a significant milestone in our national goal to eliminate schistosomiasis,” the Ministry said, urging parents, guardians, and communities to support the programme and ensure all eligible children receive treatment.

Schistosomiasis, commonly known as bilharzia, is a preventable and treatable disease. Authorities emphasize that sustained community participation is essential to breaking transmission cycles and safeguarding the health of future generations.

Current Affairs

Government Gazettes Draft Constitutional Amendment No. 3 Bill

The Government has gazetted the draft Constitutional Amendment No. 3 Bill on Monday, 16 February 2026, setting in motion a major constitutional review process that could significantly reshape Zimbabwe’s governance system.

If passed, the proposed amendment would allow President Emmerson Mnangagwa to extend his current term and would fundamentally change how national leaders, including the President, are elected. Parliament has now opened a 90-day period for public debate, after which the Bill will be formally tabled for consideration.

According to the official Memorandum, the Bill is presented as a package of “constructive reforms” aimed at strengthening constitutional governance, improving institutional efficiency, and aligning Zimbabwe’s constitutional framework with practices used in other African countries. Government says the proposals are meant to modernise the 2013 Constitution while preserving its core values.

One of the most far-reaching proposals is the introduction of a parliamentary method of electing the President, replacing the current system of direct presidential elections. Under this model, Members of Parliament would elect the President, with a run-off if no candidate secures an outright majority. The process would be overseen by electoral authorities to ensure fairness and transparency.

The Bill also proposes extending the presidential and parliamentary term from five years to seven years, a move government argues will reduce frequent election pressures and allow more time for long-term development projects to be implemented.

In another major change, responsibility for voter registration and the voters’ roll would be transferred from the Zimbabwe Electoral Commission (ZEC) to the Registrar-General. Government says this will improve efficiency, as the Registrar-General already manages national population records.

The proposed amendment further restructures electoral institutions by creating a Zimbabwe Electoral Delimitation Commission, which would take over boundary-drawing functions. This would effectively remove ZEC’s current dual role, a move authorities say promotes institutional integrity and good governance.

Other provisions include increasing the number of appointed senators to 90, giving the President power to appoint ten senators to bring in technical expertise and promote inclusivity. The Bill also expands the powers of the Constitutional Court, allowing it to hear cases of major public importance beyond constitutional disputes and presidential election petitions.

Several constitutional commissions are also affected. The Bill proposes dissolving the Zimbabwe Gender Commission and the National Peace and Reconciliation Commission, with their functions reassigned to existing bodies such as the Zimbabwe Human Rights Commission. Government argues this will reduce duplication and streamline oversight.

Judicial and security sector provisions are also amended, including changes to the appointment of the Prosecutor-General and clarifying the constitutional role of the Defence Forces.

As the 90-day consultation period begins, the proposed Constitutional Amendment No. 3 Bill is expected to generate intense national debate. Supporters say it promotes stability and efficiency, while critics are likely to question its implications for democracy, accountability, and executive power.

The coming months will determine whether these sweeping changes gain public and parliamentary approval.

-

Current Affairs3 months ago

Current Affairs3 months agoOperation restore order

-

Crime and Courts5 months ago

Crime and Courts5 months agoMasasi High School Abuse Scandal Sparks Public Outcry

-

Crime and Courts5 months ago

Crime and Courts5 months agoKuwadzana Man Jailed for Reckless Driving and Driving Without a Licence

-

Current Affairs7 months ago

Current Affairs7 months agoBreaking: ZIMSEC June 2025 Exam Results Now Available Online

-

Current Affairs6 months ago

Current Affairs6 months agoMunhumutapa Day: Zimbabwe’s Newest Public Holiday Set for Annual Observance

-

Current Affairs4 months ago

Current Affairs4 months agoBREAKING NEWS: ZANU PF Director General Ezekiel Zabanyana Fired

-

Current Affairs6 months ago

Current Affairs6 months agoNo Racism in Our Cricket: Government

-

Current Affairs6 months ago

Current Affairs6 months agoGovernment Bans Tinted Car Windows in Nationwide Crime Crackdown

Angela Gabriel

November 4, 2025 at 6:07 pm

Haa munhu uyu itsotsi 1500us kubva 14 March 2023 upto now anenge achingotaura rough apa wakamupa mari yako kune vanhu more than 30 vakatorera mari dzavo nanhasi hasati avapa mari dzavo varikuchema vamwe dzimba dzaparara